In an ideal world, everybody would have enough money for all his needs. In reality, many of us have little option but to borrow to meet our goals, both real and imagined. For banks and NBFCs, the yawning gap between reality and aspirations is a tremendous opportunity. They are carpet bombing potential customers with loan offers through emails, SMSs and phone calls. Some promise low rates, others offer quick disbursal’s and easy processes.

Technology has changed several things for the lending industry. Online aggregators help customers zero in on the cheapest loan and banks take less than a minute to approve and disburse loans. The personal loan facility from HDFC Bank is the Usain Bolt of the financial world. It takes just 10 seconds to disburse a loan to its Net banking customers. “It’s a game changer for the industry,” claims a bank official.

While technology has altered the way loans are being disbursed, the canons of prudent borrowing remain unchanged. It still doesn’t make sense to borrow if you don’t need the money. Or take a long-term loan only to enjoy the tax benefits available on the interest you pay. Our cover story this week lists out 10 such immutable rules of borrowing that potential customers must keep in mind. Follow them and you will never find yourself enslaved by debt.

RULE 1. DON’T BORROW MORE THAN YOU CAN REPAY

The first rule of smart borrowing is what the older generation has been telling us all the time: don’t live beyond your means. Take a loan that you can easily repay. One thumb rule says that car EMIs should not exceed 15% while personal loan EMIs should not account for more than 10% of the net monthly income. Your monthly outgo towards all your loans put together should not be more than 50% of your monthly income.

Can online loan portals offer you a better deal?

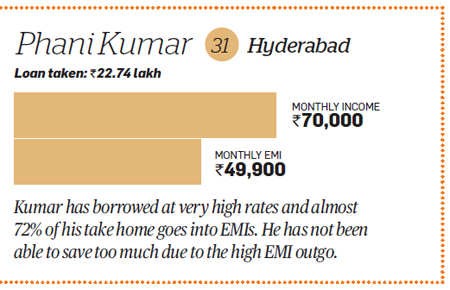

With banks falling over each other to attract business, taking a loan appears as easy as ABC. But don’t take a loan just because it is available. Make sure that your loan-to-income ratio is within acceptable limits. Hyderabad-based Phani Kumar has been repaying loans right from the time he started working.

It started with two personal loans of Rs 5 lakh six years ago. At that time, he was paying an EMI of Rs 18,000 (or 40% of his take home). Despite stretched finances, Kumar took a car loan of Rs 5.74 lakh in 2012, adding another Rs 12,500 to his monthly outgo. Last year, he took a third personal loan of Rs 8 lakh to retire the other loans and another top-up loan of Rs 4 lakh to meet other expenses. Today, he pays an EMI of Rs 49,900, which is almost 72% of his net take-home pay.

If your EMIs gobble up too much of your income, other critical financial goals, like saving for retirement or your kids’ education, might get impacted. Retirement planning is often the first to be sacrificed in such situations. Even after six years of working, Kumar’s net worth is in the negative. Make sure you don’t commit this mistake.

RULE 2. KEEP TENURE AS SHORT AS POSSIBLE

The maximum home loan tenure offered by all major lenders is 30 years. The longer the tenure, the lower is the EMI, which makes it very tempting to go for a 25-30 year loan. However, it is best to take a loan for the shortest tenure you can afford. In a long-term loan, the interest outgo is too high. In a 10-year loan, the interest paid is 57% of the borrowed amount. This shoots up to 128% if the tenure is 20 years.

If you take a Rs 50 lakh loan for 25 years, you will pay Rs 83.5 lakh (or 167%) in interest alone. “Taking a loan is negative compounding. The longer the tenure, the higher is the compound interest that the bank earns from you,” warns financial trainer P.V. Subramanyam.

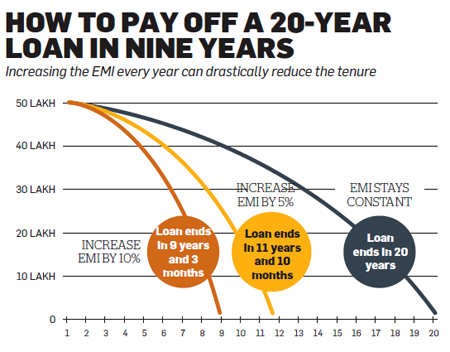

Sometimes, it may be necessary to go for a longer tenure. A young person with a low income won’t be able to borrow enough if the tenure is 10 years. He will have to increase the tenure so that the EMI fits his pocket. For such borrowers, the best option is to increase the EMI amount every year in line with an increase in the income.

Increasing the EMI amount can have a dramatic impact on the loan tenure. Assuming that the borrower’s income will rise 8-10% every year, increasing the EMI in the same proportion should not be very difficult. If a person takes a loan of Rs 50 lakh at 10% for 20 years, his EMI will be Rs 48,251. If he increases the EMI every year by 5%, the loan gets paid off in less than 12 years. If he tightens the belt and increases the EMI by 10% every year, he would pay off the loan in just nine years and three months.

RULE 3. ENSURE TIMELY AND REGULAR REPAYMENT

It pays to be disciplined, especially when it comes to repayment of dues. Whether it is a short-term debt like a credit card bill or a long-term loan for your house, make sure you don’t miss the payment. Missing an EMI or delaying a payment are among the key factors that can impact your credit profile and hinder your chances of taking a loan for other needs later in life.

Never miss a loan EMI, even if it means missing other investments for the time. In an emergency, prioritise your dues. You must take care never to miss your credit card payments because you will not only be slapped with a non-payment penalty but also be charged a hefty interest on the unpaid amount.

If you don’t have the money to pay the entire credit card bill, pay the minimum 5% and roll over the balance. But don’t make a habit of this because at an interest rate of 24-36%, credit card debt is the costliest loan you will ever take. To avoid missing the due date every month, just give standing instructions to your bank to pay the minimum 5% amount whenever the bill is due.

RULE 4. DON’T BORROW TO SPLURGE OR INVEST

This is also one of the basic rules of investing. Never use borrowed money to invest. Ultra-safe investments like fixed deposits and bonds won’t be able to match the rate of interest you pay on the loan. And investments that offer higher returns, such as equities, are too volatile. If the markets decline, you will not only suffer losses but will be strapped with an EMI as well.

There was a time when real estate was a very cost-effective investment. Housing loans were available for 7-8% and real estate prices were rising 15-20%. So it made a lot of sense to buy a property with a cheap loan. Now the tables have turned. Home loans now cost around 10% while property prices are rising by barely 4-5%. In some pockets they have even declined in the past 1-2 years.

Similarly, avoid taking a loan for discretionary spending. You may be getting SMSs from your credit card company for a travel loan, but such wants are better fulfilled by saving up. “It’s not a good idea to take a personal loan for buying luxury watches and high-end bags,” says Vineet Jain, founder of LoanStreet.in. If you must go on a holiday, throw a lavish party or indulge in some luxury shopping, start saving now.

On the other hand, taking a loan for building an asset makes eminent sense. Mumbai based Sandeep Yadav and his wife junked their plans to go on a foreign holiday and instead used the money for the down payment of their house. This way they managed to bring down the overall loan requirement for the house.

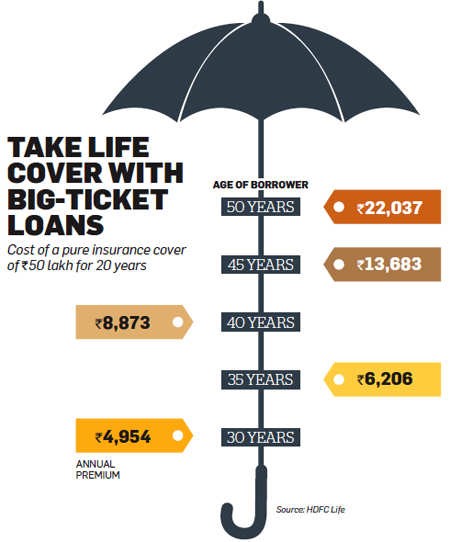

RULE 5. TAKE INSURANCE WITH BIG-TICKET LOANS

If you take a large home or car loan, it is best to take insurance cover as well. Buy a term plan of the same amount to ensure that your family is not saddled with unaffordable debt if something happens to you. The lender will take over the asset (house or car) if your dependents are unable to pay the EMI. A term insurance plan of Rs 50 lakh will not cost you too much.

Typically, banks push a reducing cover term plan that offers insurance equal to the outstanding amount. However, a regular term plan is a better way to cover this liability. It can continue even after the loan is repaid or if you switch to another lender.

Moreover, insurance policies that are linked to a loan are often single premium plans. These are not as cost effective as regular payment plans. If a lender forces you to buy an insurance plan that is linked to the loan, take up the matter with the banking ombudsmen and the insurance regulator.

RULE 6. KEEP SHOPPING FOR BETTER RATES

A long-term mortgage should never be a sign-and-forget exercise. Keep your eyes and ears open about the new rules and changes in interest rates. The RBI is planning to change the base rate formula, which could change the way your bank calibrates its lending rates. Keep shopping around for the best rate and switch to a cheaper loan if possible.

However, the difference should be at least 2 percentage points, otherwise the prepayment penalty on the old loan and processing charges of the new loan will eat into the gains from the switch.

Also, switching will be more beneficial if done early in the loan tenure. Suppose you have a loan at 11.75% and are being offered a new rate of 9.9%. You can save up to 52 EMIs if the loan still has 18 years to go. But if the loan only has five more years to go, the new loan tenure will be only three EMIs shorter. The same applies to prepayment of loans.

The earlier you do it, the bigger is the impact on the loan tenure. The RBI does not allow banks to levy a prepayment penalty on housing loans but they may levy a penalty on other loans. Some lenders do not charge a prepayment penalty if the amount paid does not exceed 25% of the outstanding amount at the beginning of the year.

RULE 7. UNDERSTAND THE FINE PRINT

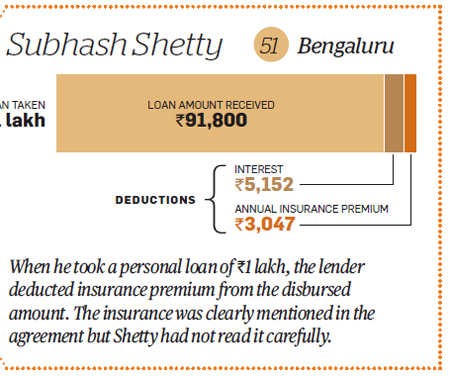

Loan documents don’t make for light reading. Paragraph after paragraph of legalese printed in a small font can be a put off. Yet, read the terms and conditions carefully to avoid unpleasant surprises. Bengaluru-based Subhash Shetty applied for a personal loan of Rs 1 lakh but received a cheque of only Rs 91,800. The lender had deducted Rs 5,152 as an upfront interest charge and an annual insurance premium of Rs 3,047.

Shetty had signed on the papers without going into the fine print. Some lenders are notorious for slipping in clauses that are loaded against the borrower. If you are unable to understand the legalese, get a financial advisor or chartered accountant to take a look at the agreement before you sign it.

RULE 8. SUBSTITUTE HIGH COST LOANS

If you have too many loans running, it’s a good idea to consolidate your debts under one omnibus low-cost loan. Make a list of all outstanding loans and identify the high cost ones that can be replaced with cheaper loans (see table). For instance, an unsecured personal loan that charges 18-20% can be replaced with a loan against life insurance policies.

A loan against property can be used to repay all other outstanding loans. You could also consider other options like gold loans and loan against bank deposits. It is also a good idea to prepay costly loans as soon as possible. Divert windfall gains, such as annual performance bonus, tax refunds and maturity proceeds from life insurance policies towards repayment of these high-cost loans.

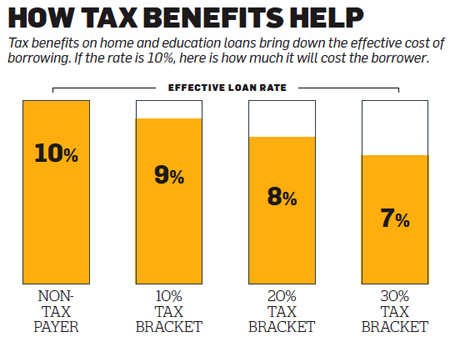

Borrowers sometimes avoid ending loans because they offer tax benefits. If a house is self-occupied, up to Rs 2 lakh interest paid on a home loan can be claimed as a tax deduction. If the house is given out on rent, the entire interest paid can be claimed as deduction. In case of education loans, the entire interest paid on the loan is tax deductible for up to eight years.

But this tax benefit alone should not be the reason to keep a loan running. True, the tax benefits bring down the effective cost of the loan. But you are still incurring an expense that can be avoided by ending the loan as soon as possible. Unless the money can earn you a better return than the effective cost of the loan, use it to prepay the outstanding sum.

RULE 9. DON’T NIX RETIREMENT BY AVOIDING LOANS

Indians are emotional about certain financial goals, especially when these relate to children. Given a choice, no parent would want to burden their children with a loan, especially for the purpose of education. While securing your child’s future is important, you need to also assess if it impacts your own future.

Dipping into your retirement corpus to fund your child’s education can be a risky proposition. Students have options like loans and scholarships to cover their education costs but there is no such arrangement to help you plan for your retirement needs. Your retirement is as important as your child’s education, perhaps even more. Do not plan for your children in isolation. Let all your goals be a part of your expense planning, it will help you balance better.

RULE 10. KEEP SPOUSE, FAMILY IN LOOP ABOUT LOAN

Before you take a loan, discuss it with your family. This is important because the repayment will impact the overall finances of the entire household. Make sure your spouse is aware of the loan and the reasons for taking it.

Keeping a spouse in the dark on money matters not only increases stress in a marriage but also precludes your chances of finding a more cost effective solution. Maybe your wife (or husband) has some spare money which can help you avoid taking the loan altogether. Don’t miss out on that opportunity by keeping your need under wraps.

REFERENCE – https://economictimes.indiatimes.com/wealth/borrow/ten-golden-rules-to-follow-when-taking-a-loan/articleshow/48932386.cms?from=mdr